Second Chances at Signing Up for Medicare

If you missed earlier enrollment periods, you can sign up at other specified times

When it comes to Medicare, timing is everything.

If you miss an enrollment deadline, you may have to wait to get coverage and pay a late-enrollment penalty. In some cases, though, you can sign up for Medicare outside of your initial enrollment period (IEP) — which starts three months before the month you turn 65 and lasts until three months after — and you won’t have to pay a late-enrollment penalty.

This is called a special enrollment period (SEP). You also can sign up during a general enrollment period (GEP), but you may have to pay a penalty.

How a special enrollment period works

If you or your spouse still works and you have health insurance through either of your employers, you might decide to sign up for premium-free Part A, which helps pay hospital costs and some skilled nursing care after a hospital stay as an inpatient. Most people don’t pay premiums for Part A because they or their spouse had Medicare taxes deducted from their paychecks for at least 10 years.

However, you might delay enrolling in Part B — which helps pay for doctor visits and other outpatient services, such as lab tests, medical equipment and X-rays — and costs $170.10 a month for most people in 2022. You might also hold off on choosing a Part D prescription drug plan because you have coverage through an employer.

When your job-based health insurance ends, either because of retirement or another reason, you can sign up for Part B during a special enrollment period. After that, you can sign up for a stand-alone Part D prescription drug policy and a Medigap policy, which can cover most of Medicare’s deductibles and copayments. Or you could buy a private Medicare Advantage plan, which can provide both medical and drug coverage.

You can’t have Medigap and a Medicare Advantage plan at the same time. No matter which route you choose, be sure you’re aware of the enrollment deadlines:

- For Part B, you’ll need to sign up before your employer coverage ends or within eight months of losing your job-based coverage to avoid a late-enrollment penalty.

Your six-month Medigap open enrollment period, when you can’t be rejected for any policy sold in your area because of health problems, generally begins the first day of the month you have Part B and are 65 or older. After that, Medigap insurers may be able to reject you or charge more because of preexisting conditions.

- For Part D, you have a shorter special enrollment period — two months after the month that your previous prescription drug coverage ends. You don’t have to sign up for Part D as long as you have what government officials call creditable coverage, which is prescription drug coverage that is considered to be as good as or better than Part D. It can come from an employer, retiree plan, Tricare military health care or another source.

The end of creditable coverage can happen for several reasons, including your retirement or your spouse’s retirement and the end of employer-provided drug coverage, the shutdown of your retiree drug plan or your move from your plan’s service area. You can decide to buy a Part D plan to cover prescriptions or enroll in a Medicare Advantage plan that includes drug coverage.

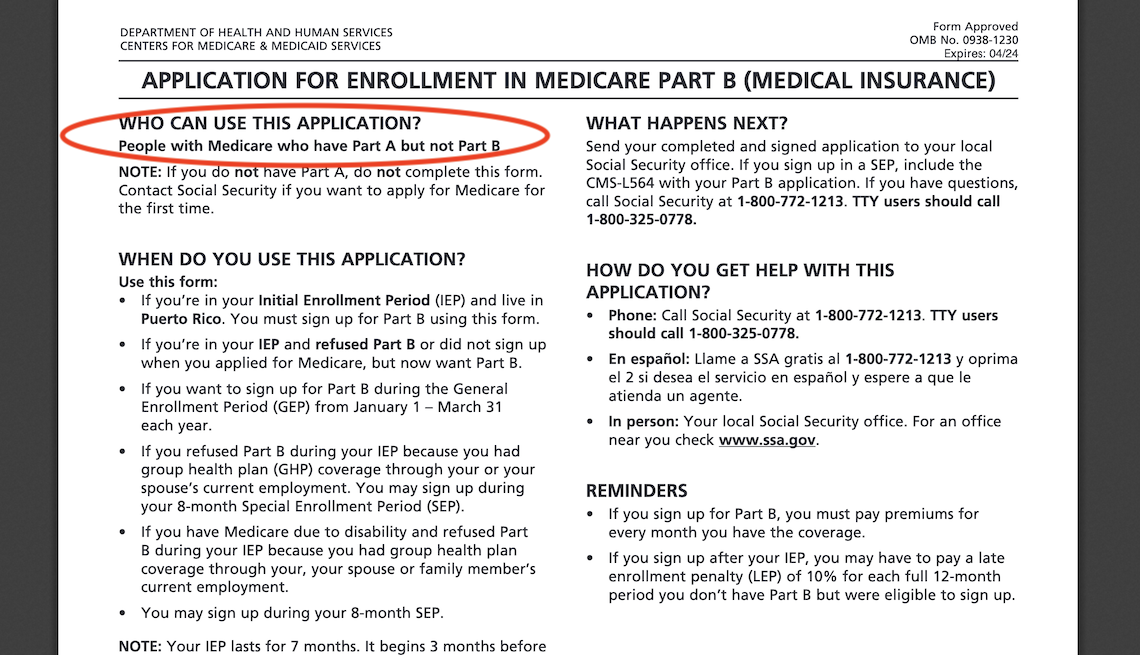

11 steps to enroll online in Part B

If you need to enroll in Part B during a special enrollment period, visit the Social Security Administration (SSA) website. To complete the form, you’ll need your Medicare number, documentation of your spouse’s or your health insurance and an email address. Be sure to use a Google Chrome or Microsoft Edge browser.

1. At the bottom of the opening page, check a box indicating that you understand the agency’s policies. Click Start application and you’ll be taken to the application page.

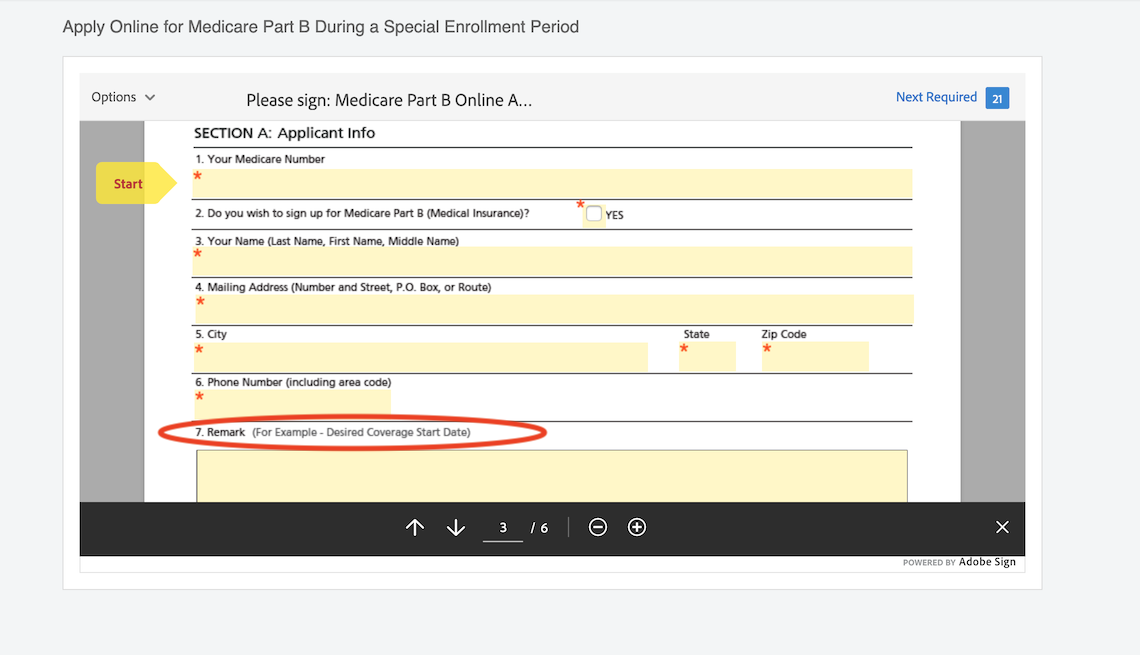

2. Scroll down and fill out the application for enrollment. Provide your Medicare number, then click Yes when you’re asked if you want to sign up for Part B. Type in your name, address and phone number. In the Remark field, mention the date you would like your Part B coverage to start.

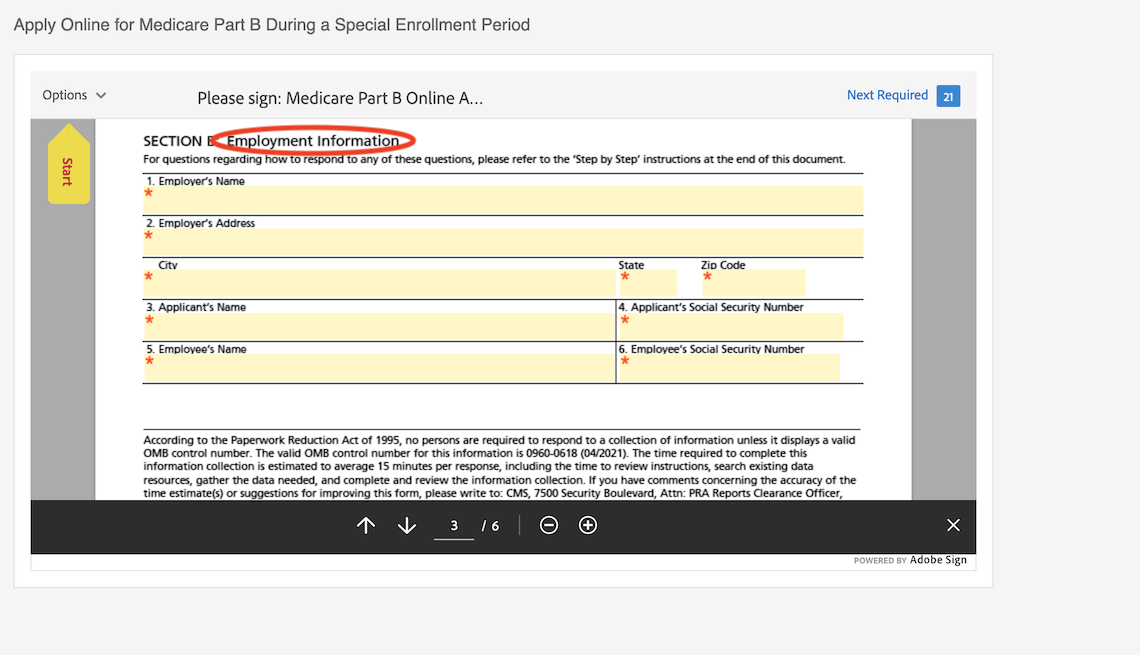

3. In Section B, provide information about the employer you’re receiving health insurance from.

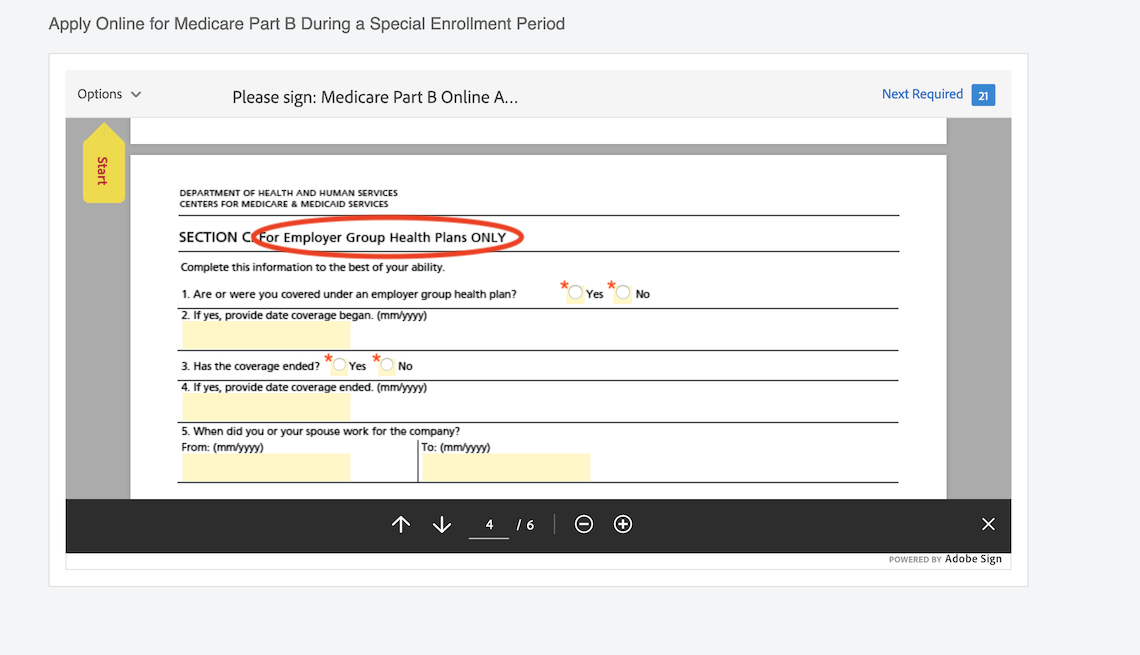

4. In Section C, provide information about your group health plan.

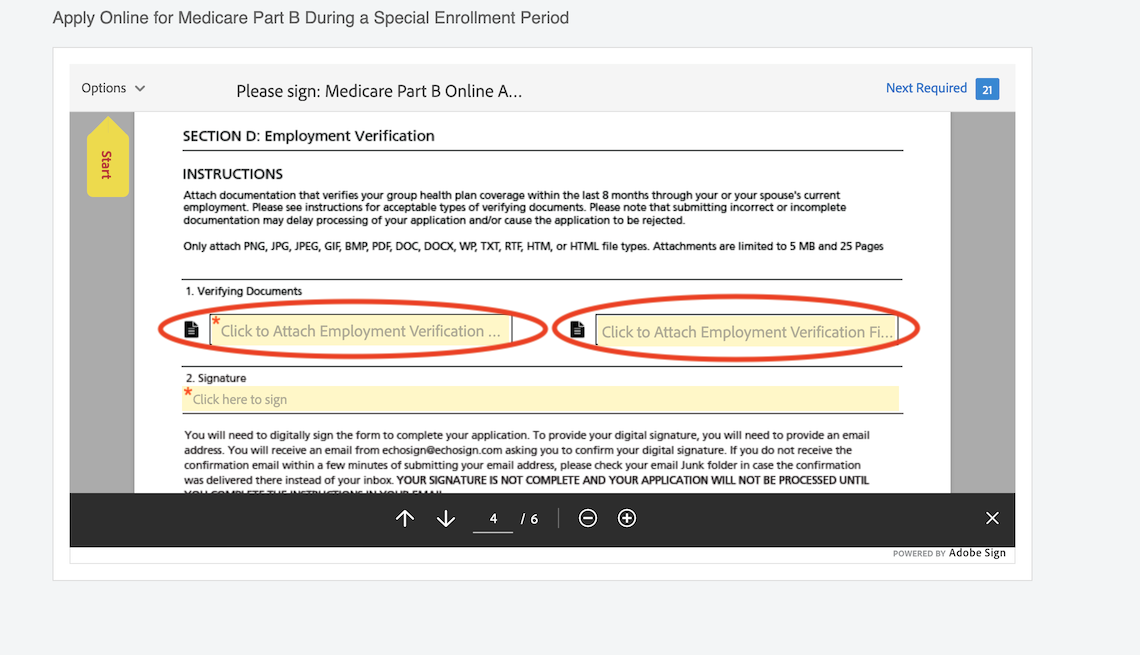

5. In Section D, you’ll need to provide evidence of your coverage. Complete Section A of form CMS- L564 and ask your employer to complete Section B. The employer can send the form directly to the SSA or the company can send you a digital copy, which you’ll need to upload as part of your application process.

If your employer cannot provide evidence of your group health coverage, you’ll need to submit proof of your employment and health insurance coverage. The following documents are acceptable:

- Explanation of benefits statement from your health plan

- Health insurance cards that show the date your policy began

- Pay stubs that indicate your health insurance premiums were deducted

- Receipts or statements that show your health insurance premiums were paid

- Tax returns that show your health insurance premiums were paid

- W-2s that show pretax medical contributions

If you need to include these documents, you’ll upload them in the yellow space.

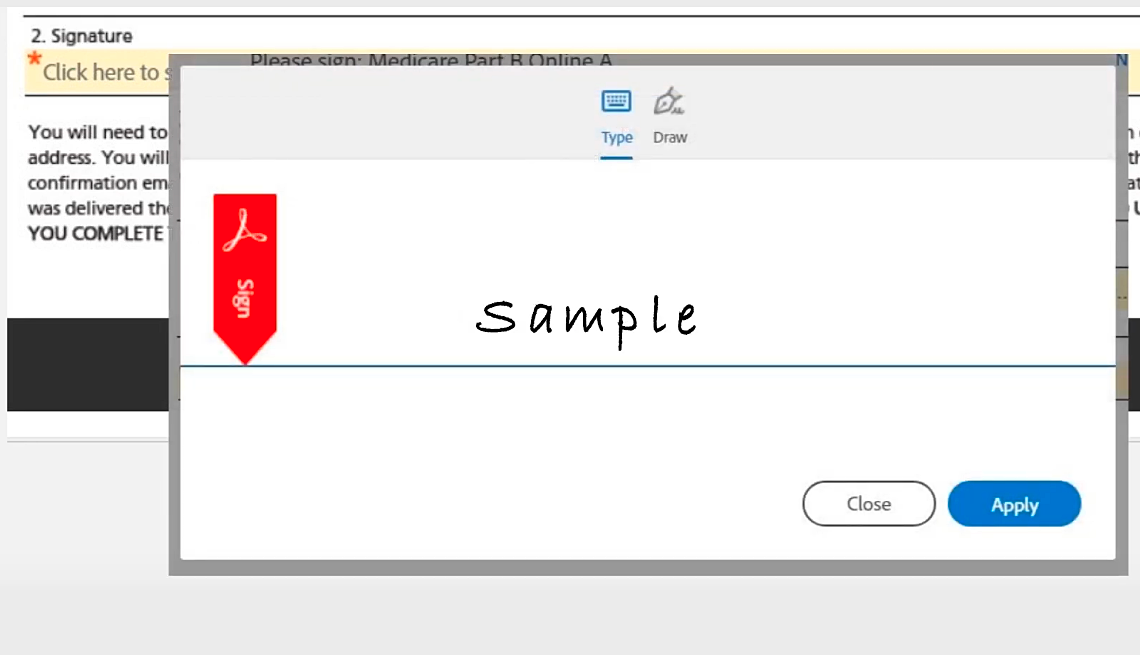

6. Once you’ve completed Section D, type in your name and click the blue Apply button.

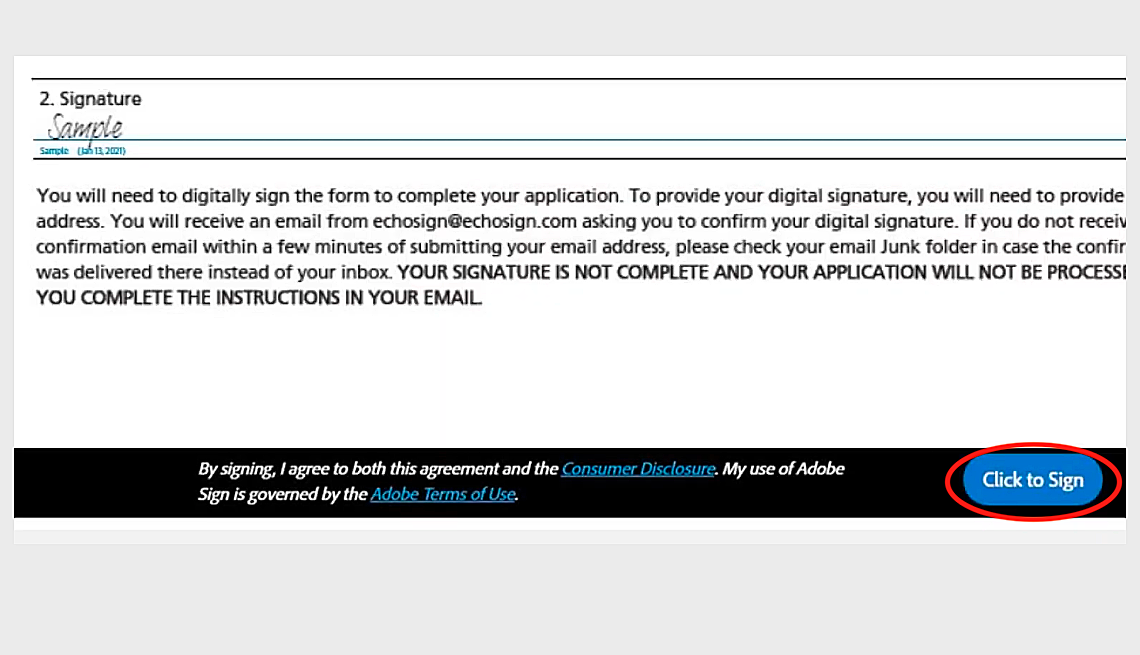

7. Watch for a screen with a black bar at the bottom, then click the blue Click to Sign button.

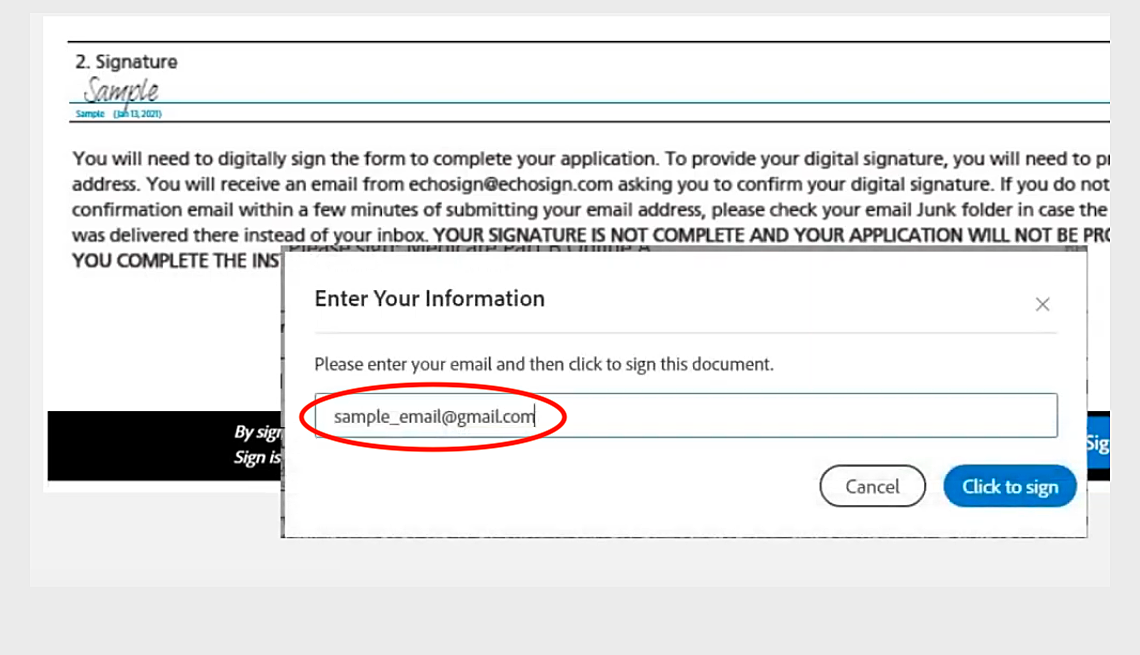

8. Now enter your email address and click the Click to Sign button.

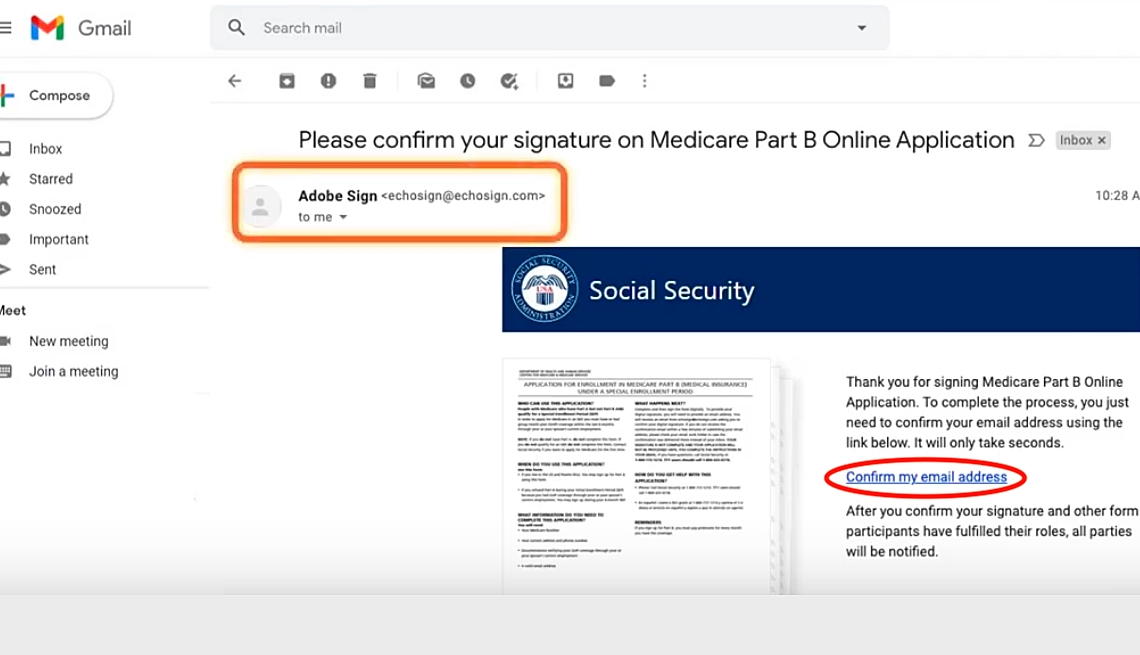

9. Go to your email account and look for a message from Adobe Sign. Click on the link that says Confirm my email address.

10. You’ll be taken to a page that confirms your e-signing was verified. Watch for a second email that confirms your application was submitted.

11. The SSA will send you a letter informing you of your application’s status. If it’s denied, you can appeal the decision by following the instructions.

Other ways to sign up

If you don’t want to enroll online, print the form and mail it, fax it or bring it to your local Social Security office. Alternatively, you can fill out Form CMS-40B and have the employer who provides your health insurance complete Form CMS-L564. If the employer is unable to complete the form, you can submit the documents that show you had health insurance.

Social Security offices opened April 7 after being closed during the COVID-19 pandemic. To avoid long lines, contact your local office to find out whether you can go in person or must mail your application.

To find your local office, use the Social Security field office locator. If you want to mail your application, use certified mail, which provides confirmation that your document was delivered. Another option is to fax the application to 833-914-2016.

How to sign up during the general enrollment period

If you missed the opportunity to sign up for Medicare during your IEP and any SEP you might be eligible for, you’ll need to enroll during the annual general enrollment period (GEP), which runs Jan. 1 to March 31 each year. You may have to pay a late-enrollment penalty.

If you sign up during this time, your coverage will begin July 1. Starting in 2023, coverage will begin the first of the month after you sign up. Follow these steps to sign up during a GEP:

Signing up for Parts A and B

If you’re eligible for premium-free Part A, you can enroll anytime by contacting the Social Security Administration at 800-772-1213. How much you'll have to pay for Part A depends on how long you've worked. You need 40 work credits (generally 40 quarters of work) to avoid paying the Part A premium. If you have accrued fewer than 40 credits and don’t have a spouse — or an ex-spouse if you were married more than 10 years and haven’t remarried — who has earned 40 credits or more, you’ll have to pay a premium for Part A and a penalty for signing up after your IEP or any SEP you might qualify for.

AARP Membership -Join AARP for just $12 for your first year when you enroll in automatic renewal

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

The SSA has no paper form available for enrollment in Part A during the GEP, so you must call. To sign up for Part B, complete Form CMS-40B and mail it to your local Social Security office or call for assistance.

No option exists now to enroll online if you need to do so during a general enrollment period. Social Security offices opened April 7 after being closed during the COVID-19 pandemic. To avoid long lines, contact your local office to find out whether you can go in person.

How to avoid penalties

Keep in mind: If you delayed signing up for Medicare because you or your spouse were working, you need to enroll within eight months of losing your health insurance. Otherwise, you may have to pay a late-enrollment penalty.

This amounts to 10 percent of your Part B premium for each 12-month period you could have had Part B but didn’t enroll. If you had job-based coverage during that time, those months won’t count when the penalty is calculated.

To prove that you had health insurance, the employer who provided the insurance should fill out Form CMS-L564 and send it to the Social Security office along with your application.

Images: Social Security Administration (SSA.gov); Centers for Medicare & Medicaid Services

This story, published Jan. 28, was updated to reflect the opening of Social Security local offices.

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger's Personal Finance magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.