Use Medicare's Plan Finder to Choose, Enroll in Part D

If you don't have adequate prescription drug coverage already, you'll need to pick a plan

When you sign up for Medicare, you’ll get coverage for most of your health care expenses.

Part A helps pay for hospital costs and some skilled nursing care after an inpatient hospital stay. Part B helps pay for doctor visits and other outpatient services, such as lab tests, medical equipment and X-rays. But prescription drug coverage is not included.

You can get prescription coverage in two ways: If you have original Medicare, which includes Parts A and B, you can buy a standalone Part D prescription drug plan. Or you can purchase a Medicare Advantage plan that combines medical and drug coverage in its benefit package.

You can sign up for Part D plans only at certain times, and you may have to pay a late-enrollment penalty if you delay and don’t have other coverage.

If you have drug coverage, find out if it’s as good or better than a basic Part D plan, what’s known as creditable coverage. Every September your health plan should send you a notice telling you whether your current coverage is considered creditable.

If you have creditable coverage, you do not need to sign up for Part D. If you don’t, you’ll need to find a plan or face a late-enrollment penalty that will be added to your Part D premium every month.

If you don’t have creditable prescription drug coverage, the best time to sign up for a Part D plan is during the seven-month initial enrollment period surrounding your 65th birthday — even if you don’t take any daily prescriptions now. If you decide to enroll in an economical plan to avoid penalties, you can change your coverage during Medicare’s annual open enrollment period Oct. 15 to Dec. 7. Coverage starts Jan. 1.

8 steps to sign up for a Part D plan

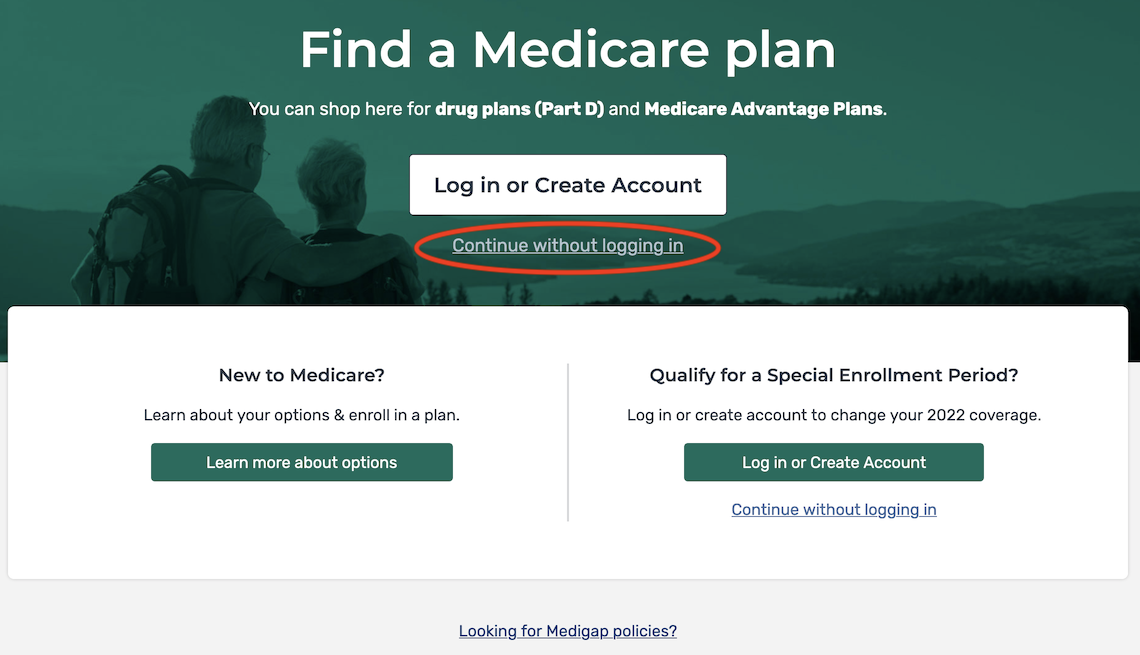

1. Compare the Part D options in your area by using the Plan Finder tool at Medicare.gov.

You can log in to your Medicare account to get information about the plans in your area. You also can use the tool without logging in.

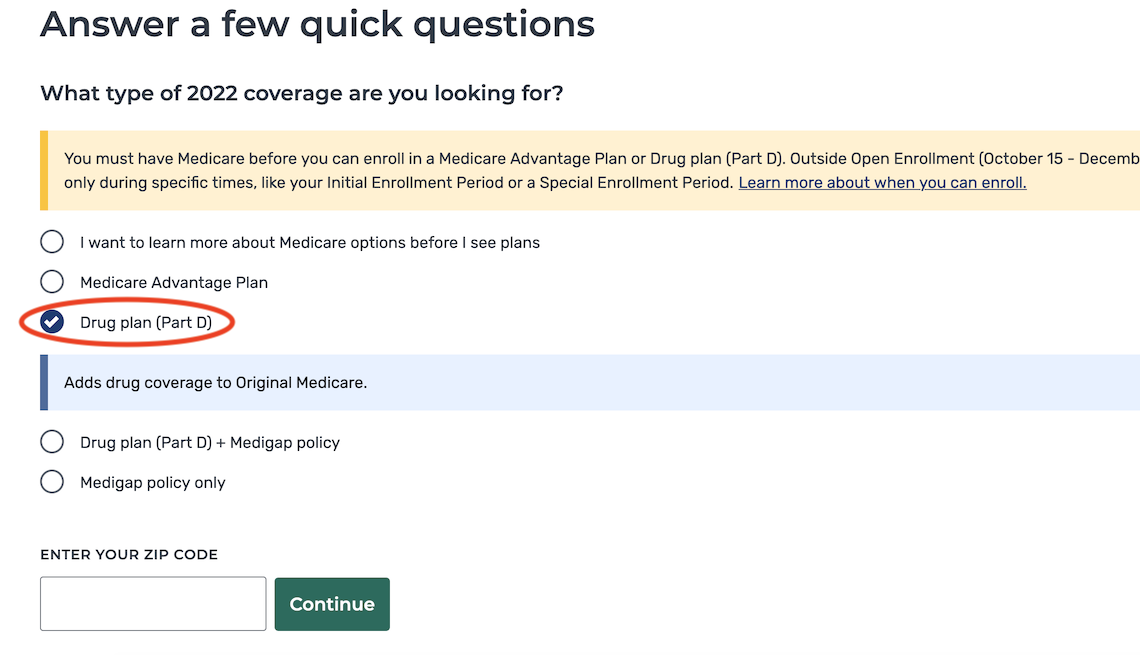

2. If you select Continue without logging in, you’ll be able to choose the type of coverage you want, such as a Part D drug plan. Enter your zip code and select your county.

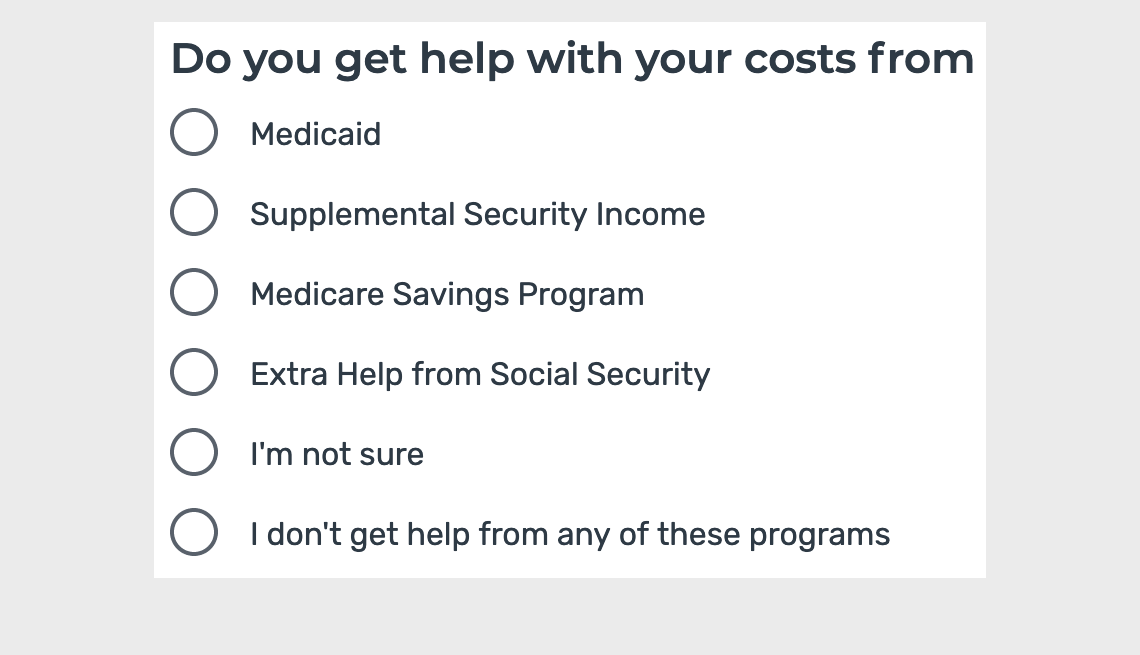

3. Now indicate whether you get help with your medical expenses. If you’re not sure, you can find out by logging in to your Medicare account.

4. If you don’t receive any help, you’ll be asked if you want to see your drug costs when you compare plans. Click Yes so you can get a sense of how much you would spend with each plan.

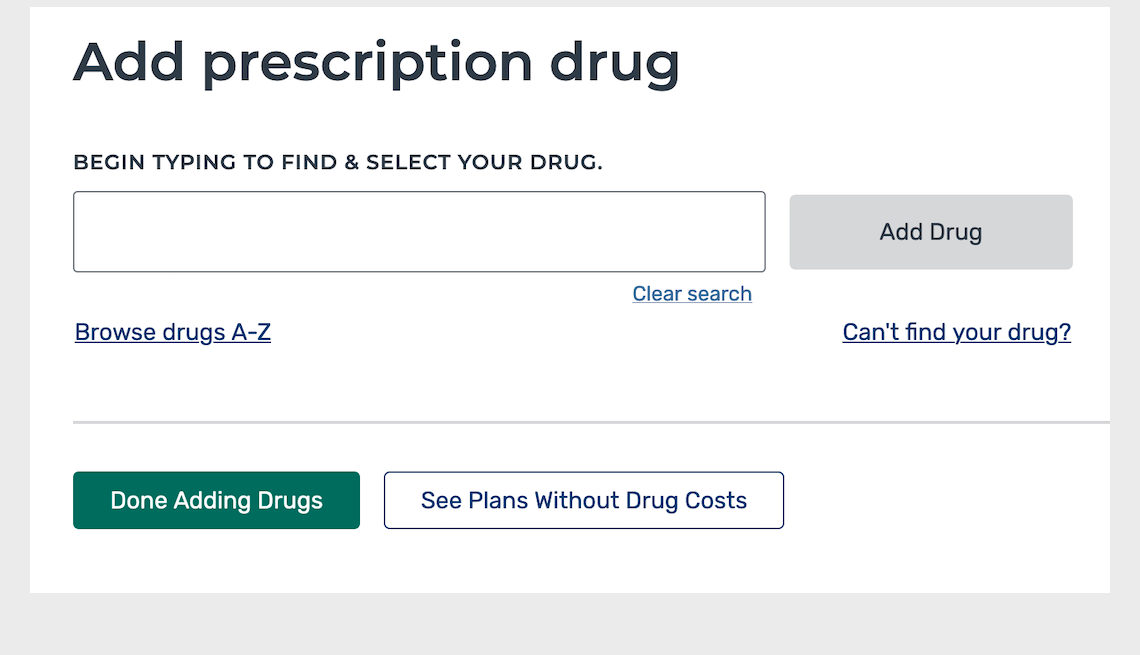

5. Enter the names of your medications. Be sure to include ones you take regularly so that you’ll get a good estimate of ongoing costs. You’ll also need to select the dosage and quantity and indicate how frequently you need to refill your prescriptions. To add another medication, click Add Another Drug. When you’re finished, click Done Adding Drugs.

6. Choose up to five pharmacies where you want to fill your prescriptions. Many plans charge lower copayments for preferred pharmacies. You can see how plans work with the pharmacies and what your copayments would be for each one. Enter the names of pharmacies you use or search by your address or zip code.

Every plan with drug coverage offers mail-order prescriptions. They can be less expensive, so some people select this option as one of their pharmacy choices. When you’re finished selecting pharmacies, click Done.

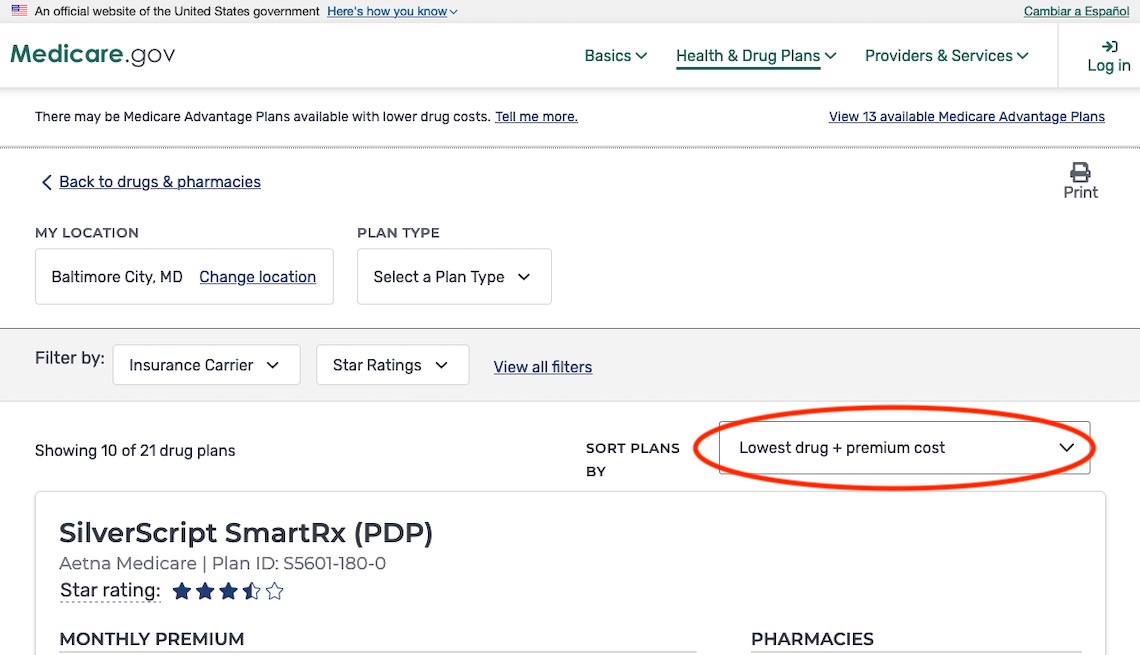

7. You’ll receive a list of drug plans in your area. You can sort the plans in three ways: Lowest drug + premium cost, the default; Lowest yearly drug deductible; and Lowest monthly premium. The best way to compare plans is to look at each plan’s lowest drug and premium costs.

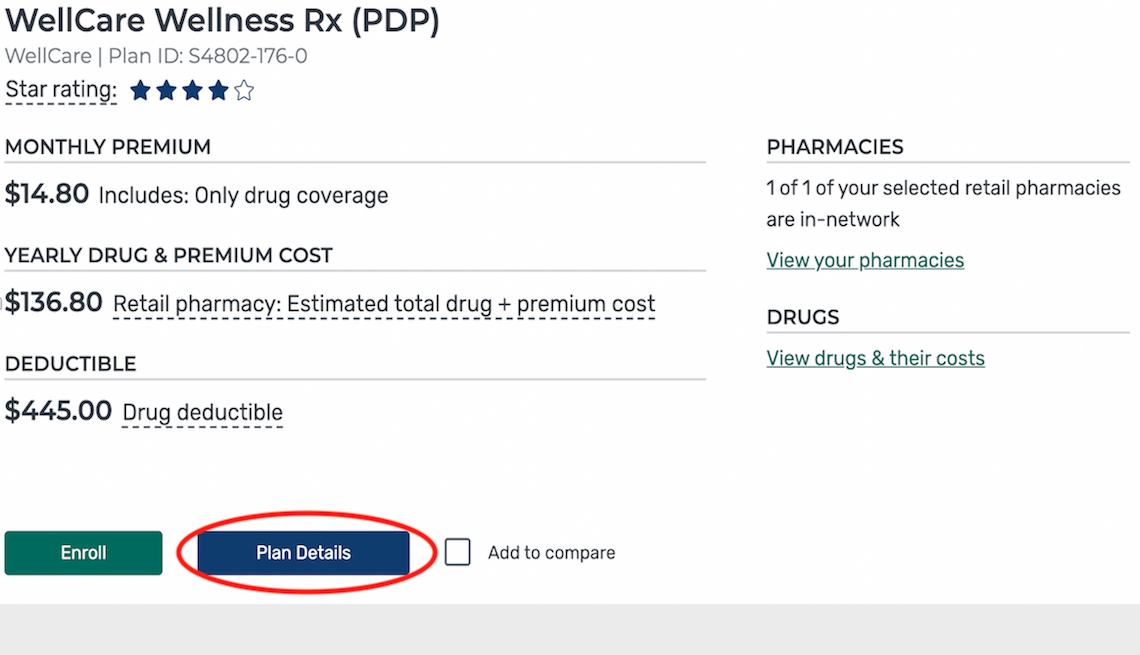

Keep in mind: A plan with a low premium could be more expensive by the end of the year if it charges high copayments for your medications. Click the Plan Details button for more information, including a monthly estimate of what you will pay for your medications.

If you are interested in a plan, be sure to check before signing up whether your prescriptions are part of a plan’s formulary — the list of regularly covered drugs. Some expensive medicines require prior authorization from the plan before you can purchase them.

8. To sign up for a Part D plan, click Enroll. You’ll need your Medicare number and the date that your Parts A and B coverage started. You may be able to enroll with an insurance agent or by calling 800-MEDICARE (800-633-4227).

To sign up directly with the insurance company, click Plan Details and look for the plan’s phone number and website. You can also request an application and mail it. An insurance agent may be able to help you enroll.

For help signing up for a Part D plan, contact your State Health Insurance Assistance Program (SHIP).

How to pay for Part D

After you’ve signed up, you’ll pay monthly Part D premiums to the insurance company. You may either receive bills or sign up for automatic payments. You also may be able to request that your premium be deducted from your monthly Social Security or Railroad Retirement Board payment.

Medicare beneficiaries with low incomes and few assets may qualify for the federal Extra Help program that gives financial assistance to pay for Part D premiums, deductibles and copayments.

AARP Membership -Join AARP for just $12 for your first year when you enroll in automatic renewal

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Who pays the high-income surcharge?

If your adjusted gross income is more than $91,000 if you’re single or $182,000 if you’re married and filing jointly, you may have to pay a high-income surcharge, which adds $12.40 to $77.90 to your monthly Part D premiums in 2022.

The high-income surcharge is paid to Medicare. These premiums can be deducted automatically from your Social Security benefits, or Medicare can send you a bill. Another option is to sign up for Easy Pay and have the premiums automatically paid from your checking or savings account.

Mark your calendar for Medicare’s annual open enrollment period from Oct. 15 to Dec. 7. This is the time you can switch Part D plans.

Even if you’re satisfied with your coverage, it’s a good idea to go to Medicare.gov to compare the plans available in your area. Plans can change their coverage, costs and provider networks every year.

Images: Medicare.gov

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger's Personal Finance Magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.