Paid Family Leave: States With Workplace Laws to Help Parents and Caregivers

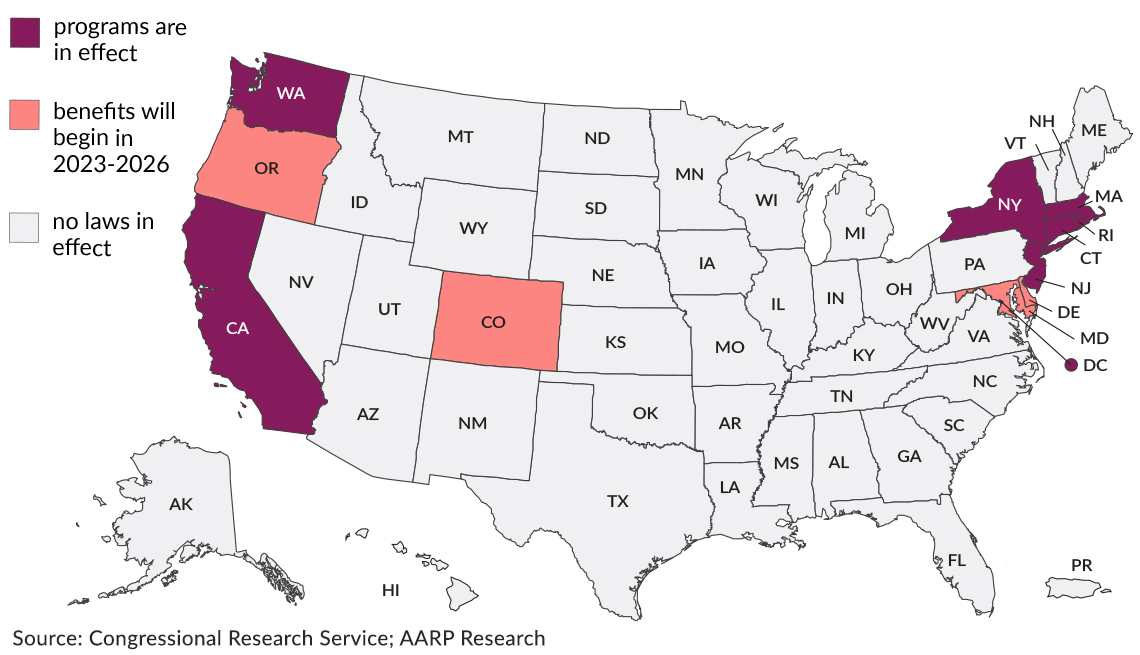

7 states and D.C. have provisions for workers to get paid time off for caregiving

While the federal government does not require private employers to offer paid family leave, some states have enacted legislation to create mandatory family-leave insurance programs to provide paid time off for caregivers and new parents.

About 48 million people in the United States, a majority of them with full-time or part-time jobs, provide unpaid care to older or disabled adults, devoting, on average, nearly 24 hours a week to caregiving, according to the “2020 Caregiving in the U.S.A.” study from AARP and the National Alliance for Caregiving. Numbers like that have pushed state and federal lawmakers to take a new look at providing paid leave for caregiving and other family responsibilities.

Less than a quarter of U.S. workers had access to employer-provided paid family leave in 2021, according to the federal Bureau of Labor Statistics.

AARP has long advocated for a national policy on paid family and medical leave. “Anyone can end up needing to care for someone,” Nancy LeaMond, chief advocacy and engagement officer for AARP, wrote in a September 2021 blog post. “We need to empower everyone to take care of their loved ones without losing pay.”

President Biden’s proposed Build Back Better Act includes provisions to establish such a program nationwide, but it is stalled in Congress. As of June 2022, only seven states and the District of Columbia had government-sponsored family-leave insurance programs in effect. Four other states have enacted similar measures that will take effect in the next few years, most recently Delaware, where Gov. John Carney signed a family-leave bill into law May 10.

Payroll taxes cover the cost of this insurance, with contributions drawn from employees, employers or both. All state programs enacted to date provide paid time off to care for a family member with a serious health condition or to bond with a newborn or newly adopted child.

Some programs also cover paid leave for workers coping with their own illness; certain situations arising from a family member’s military deployment; or domestic violence, harassment or sexual assault.

The amount of time off, and which family members you can take leave to care for, varies from state to state. Where a program covers care for children, parents, grandparents and siblings, it generally includes step, in-law, adoptive and legal relationships. Some states exempt very small companies, certain types of employers (for example, tribal entities or religious organizations) or those with their own, state-approved family leave programs. Click the links for details on each state’s policies.

California

Effective date: in effect

Maximum benefit: $1,540 a week

How it works: California was the first state to enact paid family leave, launching its program in 2005. Employees can receive 60 percent to 70 percent of their weekly earnings, up to the maximum benefit, for up to eight weeks within any 12-month period, to care for an ill spouse, child, parent or registered domestic partner.

Colorado

Effective date: Benefits begin Jan. 1, 2024; employer and employee contributions to finance the program begin Jan. 1, 2023.

Maximum benefit: $1,100 a week in 2024; 90 percent of the state’s average weekly wage thereafter

How it works: Approved by voters in a 2020 ballot measure, Colorado’s program gives employees up to 12 weeks to care for a seriously ill family member, defined as a spouse, child, parent, grandchild, grandparent, sibling or other individual with whom the worker “has a significant personal bond that is or is like a family relationship.”

The benefit calculation is 90 percent of a worker’s pay up to half the state average weekly wage, and 50 percent of any earnings beyond that.

Connecticut

Effective date: in effect

Maximum benefit: $780 a week through June 2022, rising to $840 on July 1, 2022, and $900 a week beginning June 1, 2023

How it works: Most workers will be eligible for up to 12 weeks off to care for a seriously ill spouse or domestic partner, sibling, child, grandparent, grandchild, parent or other person “whose close association with the employee shows to be the equivalent of those family relationships.”

Employees who make up to 40 times the state minimum wage of $13 an hour — that is, those making up to $520 a week — will receive up to 95 percent of their pay during family leave. A different calculation will be used for those who earn more than that, with benefits capped at 60 times the minimum wage, or $780 a week.

Delaware

Effective date: Benefits begin in 2026; employers and employees begin paying into the system Jan. 1, 2025.

Maximum benefit: $900 a week in 2026 and 2027, increasing annually thereafter based on inflation.

How it works: Workers will be able to get up to six weeks of paid leave over any 24-month period to care for a parent, spouse or child with a serious health condition. The benefit amount will be 80 percent of the employee’s average weekly wage, up to the maximum.

District of Columbia

Effective date: in effect

Maximum benefit: $1,009 a week

How it works: Employees receive up to six weeks’ pay to care for a family member with a serious health condition, including a child, parent, grandparent, sibling, spouse or domestic partner.

Maryland

Effective date: Benefits begin Jan. 1, 2025; employer and employee contributions to finance the program begin Oct. 1, 2023.

Maximum benefit: $1,000 a week in 2025, with annual increases indexed to inflation thereafter

How it works: Maryland lawmakers passed the Time to Care Act late in their 2022 legislative session and overrode Gov. Larry Hogan’s veto. Workers will be eligible for up to 12 weeks of paid leave to care for an immediate family member (spouse, child or parent)with a serious health condition. Benefit amounts are based on the worker’s average weekly pay and can range in the first year of the program from $50 to $1,000 a week.

Massachusetts

Effective date: in effect

Maximum benefit: $850 a week

How it works: Employees can get paid leave for up to 12 weeks to care for a spouse or domestic partner, child, parent, grandchild, grandparent or sibling with a serious health condition. Benefit payments are 80 percent of weekly earnings up to half of the state’s weekly average wage (or $847 in 2022) and 50 percent of any earnings above that.

New Jersey

Effective date: in effect

Maximum benefit: $993 a week

How it works: Workers can receive 85 percent of their average weekly earnings, up to the maximum, for up to 12 consecutive weeks or 56 days of intermittent caregiving in a 12-month period. The time can be taken to care for a spouse or domestic partner, child, grandchild, parent, parent-in-law, grandparent, “chosen family” or “any other individual related by blood or that you consider to be family.”

New York

Effective date: in effect

Maximum benefit: $1,068

How it works: Employees can receive 67 percent of their average weekly earnings, up to the maximum, for up to 12 weeks to care for a family member with a serious health condition. The program currently covers care for spouses, domestic partners, children, parents, parents-in-law, grandparents and grandchildren; starting Jan. 1, 2023, it will cover siblings, as well.

Oregon

Effective date: Benefits begin Sept. 1, 2023; employers and employees begin paying into the system Jan. 1, 2023.

Maximum benefit: 100 percent of average weekly wage

How it works: Workers who have been with a company for at least 180 days will be able to take up to 12 weeks a year to care for a family member — defined as “any person related by blood or whose relationship with you is like family” — with a serious health condition. Companies with fewer than 25 employees are not required to provide paid family leave, but they may be eligible for state grants if they opt to do so.

Rhode Island

Effective date: in effect

Maximum benefit: $978 a week

How it works: Employees receive about 60 percent of weekly earnings for up to five weeks to care for a child, spouse, domestic partner, parent, parent-in-law or grandparent with a serious health condition. The minimum weekly benefit is $107.

Washington

Effective date: in effect

Maximum benefit: $1,327 a week

How it works: Workers can receive up to 90 percent of their weekly pay, up to the maximum, for up to 12 weeks to care for a seriously ill spouse or domestic partner, child, parent, sibling, grandparent, grandchild, in-law or “someone who has an expectation to rely on you for care.”

Keep in mind

• Some states require employees to give advance notice, typically 30 days, before taking paid family leave, although there may be exceptions for unforeseeable circumstances. Check with your human resources department about notice policies.

• Taxes often are not deducted from the amount you receive for paid family leave, and the income is taxable.

Editor's note: This article, published Sept. 25, 2019, has been updated to reflect new information on state policies.

Clarification: An earlier version of this article listed Maine as having a paid family leave program. Maine has a leave law guaranteeing workers a minimum amount of paid time off for general purposes but does not require employers to provide paid family leave.