Get Help Paying for Medicare Premiums, Deductibles, Copays

The cost sharing on the various parts can be too expensive for some Americans

Medicare covers most of your health care expenses after you turn 65, but it isn’t free. You’re required to share some of the costs.

If you or your spouse had Medicare taxes deducted from your paychecks for at least 10 years, you won’t have to pay a premium for Part A hospital coverage. Otherwise, you’ll pay premiums of $274 or $499 a month in 2022. In addition, you’ll pay deductibles, coinsurance and copayments for hospital stays, skilled nursing care and other expenses.

Part B helps pay for doctor visits and other outpatient services, such as lab tests, medical equipment and X-rays, and costs $170.10 a month for most people in 2022. Plus, you’ll usually have to pay a deductible and 20 percent coinsurance for Part B expenses.

Part D provides coverage for prescription drugs, but you’ll pay monthly premiums and copayments or coinsurance based on your specific medications. Also, many plans have a deductible before coverage kicks in.

Fortunately, several programs provide financial assistance to people with limited resources or certain diseases. They can help pay Medicare premiums, deductibles, copayments and prescription drug costs.

Here’s how the programs work and how to find out if you’re eligible.

Reducing your costs for Parts A and B

State-run Medicare Savings Programs can help people with low incomes pay their Part B premiums. Some of these programs can also help pay Part A premiums for those who aren’t eligible for free Part A. They may cover deductibles, coinsurance and copayments.

To be eligible for a Medicare Savings Program, your income — and sometimes your savings — must be below certain limits, which vary by state. These limits are generally higher than those required to qualify for Medicaid, and some states don’t count your savings.

AARP Membership -Join AARP for just $12 for your first year when you enroll in automatic renewal

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Certain assets are never included in the calculation, such as your primary residence, one car, household goods and life insurance with a cash value of less than $1,500. Some states may exclude other assets, too. As of December 2021, nine states — Alabama, Arizona, Connecticut, Delaware, Louisiana, Mississippi, New York, Oregon and Vermont — and the District of Columbia did not limit the amount of assets people may own to be eligible for their Medicare Savings Programs.

The subsidies can help you pay your Part A premiums, if you have them, and Part B premiums, whether you have original Medicare or Medicare Advantage. People who are 65 and older as well as younger adults with disabilities who are enrolled in Medicare but don’t qualify for Medicaid also may be eligible for the following programs:

- The Qualified Medicare Beneficiary Program pays your premiums, deductibles, coinsurance and copayments for parts A and B and Medicare Advantage plans. For those in original Medicare, it operates like a Medigap plan. In most states, you can qualify if your gross monthly income in 2022 doesn’t exceed $1,153 for individuals or $1,546 for couples. And in most states, individuals can’t have more than $8,400 in assets and couples can’t have more than $12,600 in assets.

- The Specified Low-Income Medicare Beneficiary Program pays Part B premiums. In most states, you can qualify if your gross monthly income in 2022 doesn’t exceed $1,379 for individuals and $1,851 for couples. And in most states, individuals can’t have more than $8,400 in assets and couples can’t have more than $12,600 in assets.

- The Qualifying Individual Program pays Part B premiums with a slightly higher income limit than the Specified Low-Income Medicare Beneficiary Program. In most states, you can qualify if your gross monthly income in 2022 doesn’t exceed $1,549 for individuals and $2,080 for couples. And in most states, individuals can’t have more than $8,400 in assets and couples can’t have more than $12,600 in assets.

In addition to these benefits, if you qualify for any of the three Medicare Savings Programs above, you are automatically eligible for Extra Help, which helps cover Part D prescription drug plan premiums and out-of-pocket costs. If you receive a late-enrollment penalty for Part B, it will be waived.

A fourth Medicare Savings Program, the Qualified Disabled and Working Individuals Program, is designed specifically for people with disabilities who have returned to work, lost Social Security disability benefits and don’t qualify for premium-free Part A of Medicare because they’re working again. In most states, its monthly income limits in 2022 are $4,615 for individuals, $6,188 for couples. Its asset limits in most states are $4,000 for individuals and $6,000 for couples.

For more information, see the Medicare Rights Center's Medicare Savings Program financial eligibility guidelines.

Are you eligible?

To find out if you qualify for a Medicare Savings Program, contact your local Medicaid office or State Health Insurance Assistance Program or call 800-MEDICARE.

Application requirements vary by state, but you usually need to provide proof of income and information about your assets. If you apply for the Extra Help program (more details on that below), your application will be forwarded automatically to your state to determine whether you qualify for a Medicare Savings Program unless you specify otherwise.

Puerto Rico and the U.S. Virgin Islands don’t have Medicare Savings Programs. But Medicaid, which provides health insurance to people with low incomes, may be able to assist.

For more information about Medicaid in Puerto Rico, visit Medicaid.pr.gov. In the U.S. Virgin Islands, Medicaid is called the Medical Assistance Program.

Making Part D more affordable

If you need assistance paying the premiums, deductibles and copayments for Part D prescription drug plans, you can apply for a federal program called Extra Help.

To qualify in 2022, your savings, investments and real estate — not counting the home you live in — must be worth less than $30,950 if you are married and living with your spouse or $15,510 if you are not married or not living with your spouse.

You don’t need to include these items in your calculations: your home, vehicles, personal possessions, life insurance, burial plots, irrevocable burial contracts, or certain back payments from Social Security or Supplemental Security Income (SSI). Extra Help has a broader number of items that can be excluded from the asset limit than the Medicare Savings Programs, and that includes more than one vehicle.

For more information about eligibility, see the Social Security Administration publication Understanding the Extra Help With Your Medicare Prescription Drug Plan. Note that you’ll automatically qualify for the program if you have Medicare and SSI benefits or Medicaid coverage.

If you qualify for Extra Help, you will also need to enroll in a Part D prescription drug plan. If you don’t choose a plan, Medicare will enroll you in one automatically. Check the Medicare Plan Finder to find a plan that covers your medications.

6 steps to apply for Part D Extra Help

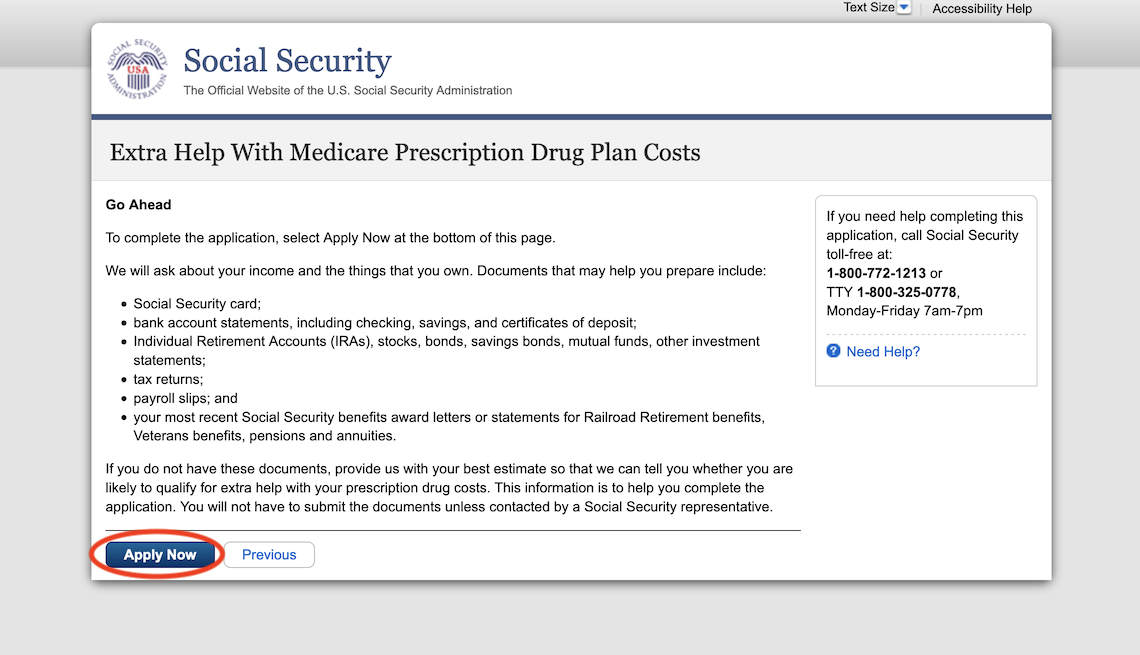

1. Gather the following documents:

- Social Security card

- Bank account statements

- IRA and investment statements

- Pay stubs

- Tax returns

- Your most recent Social Security benefits award letters or statements for Railroad Retirement benefits, Veterans Affairs benefits, pensions and annuities. You don’t have to submit these documents unless a Social Security representative contacts you.

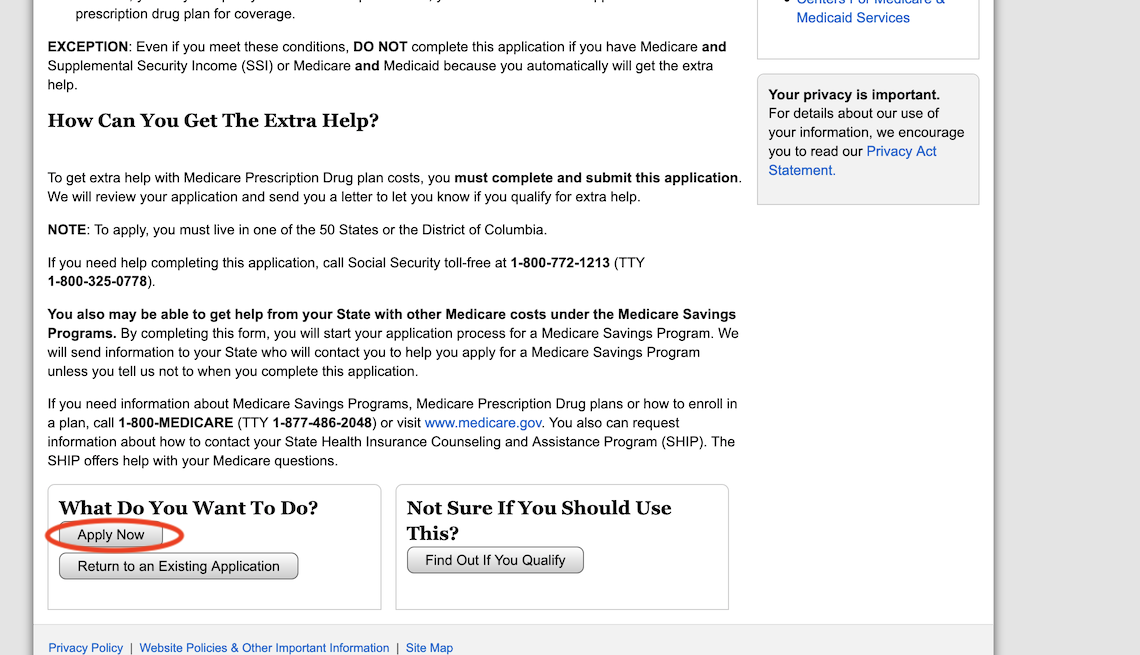

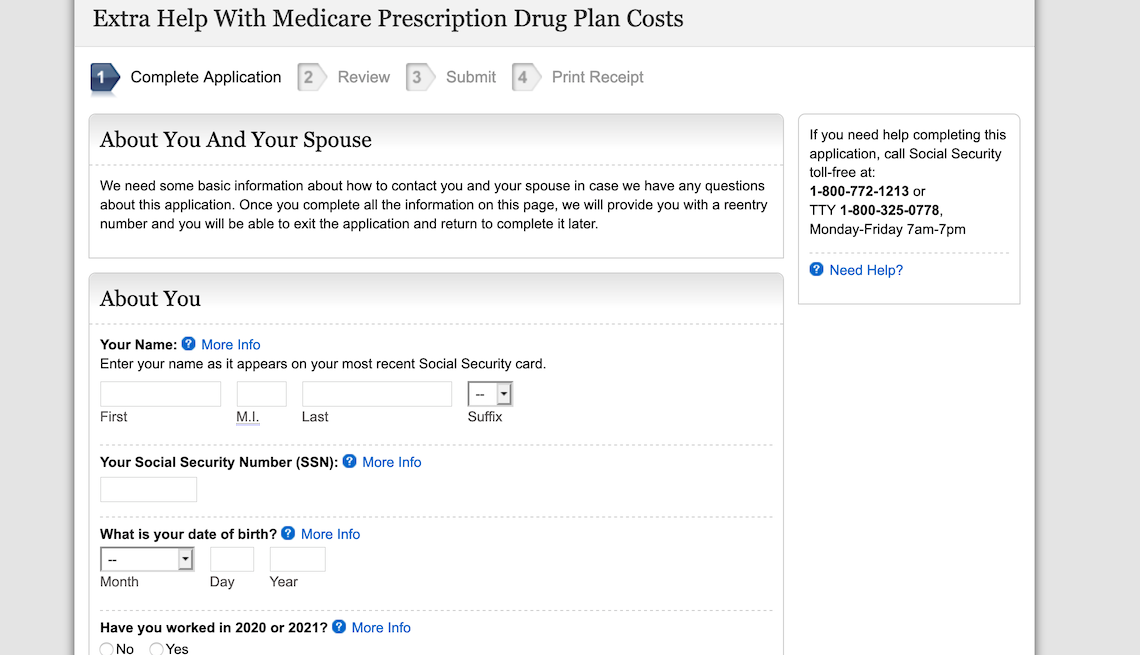

2. Use the online application and select Apply Now.

3. The next screen will explain how to fill out the online application. When you’re done reviewing it, click Next.

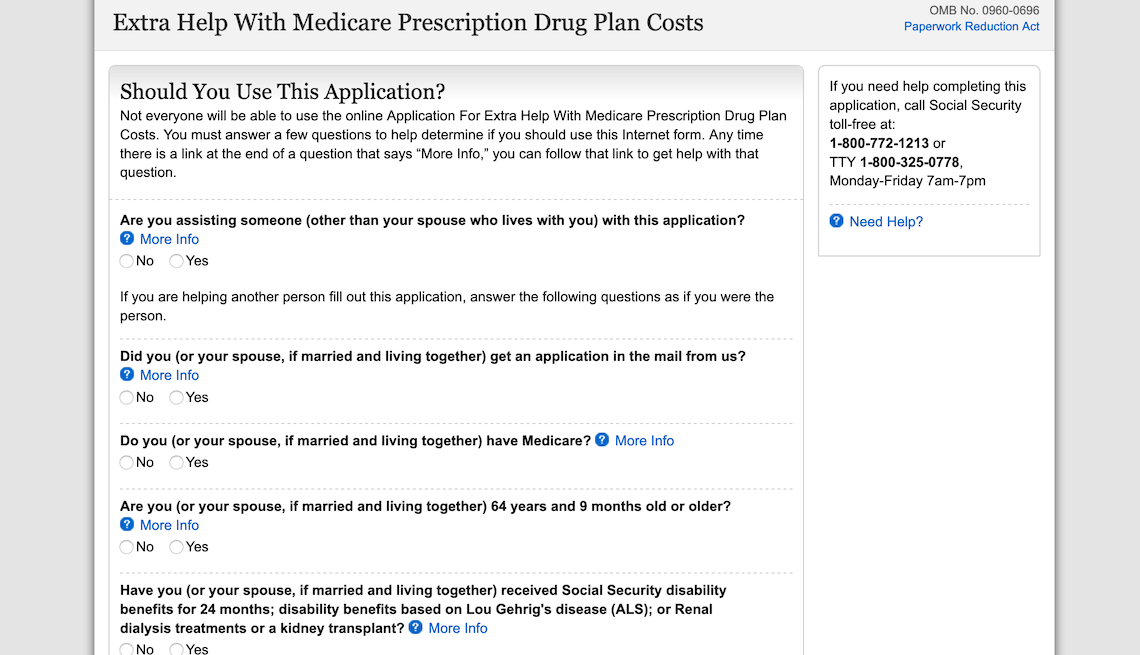

4. Now you’ll be asked a series of personal questions. Answer them and click Next.

5. Your answers to the previous questions are early steps in determining your eligibility for the program. If you qualify so far, you’ll be asked to apply. Click Apply Now.

6. On the next screen, enter your name, Social Security number, date of birth and whether you worked this year and last year. You’ll also need to supply information about your spouse, such as whether he or she wants to apply for Extra Help, too.

You’ll be asked about your income and assets, which will help determine if you’re eligible for the program.

Complete the application. You’ll be able to review it before you submit it.

If you need help completing the application, contact Social Security at 800-772-1213 or your State Health Insurance Assistance Program (SHIP). The Social Security Administration provides instructions in several languages for filling out the application. Click on the box with your preferred language and you'll see links to instructions for many Social Security forms. Because you'll also see links to English-language instructions on these pages, you can search that web page for the English words Extra Help. The link above will be instructions for your language.

Medicare will send you a notice about the level of assistance from the Extra Help program that you’ll receive. You may get full or partial assistance depending on your income and assets and whether you have Medicaid coverage or receive aid from a Medicare Savings Program.

How much extra help will you receive?

Here’s how much you’ll pay for your medications in 2022 if you receive full or partial aid from Extra Help.

| Extra Help on ... | Annual income limit* | Asset Limit | Premium | Deductible | Copayments** | Copayments after $7,050*** |

|---|---|---|---|---|---|---|

| Medicare only | single, $18,588; married, $24,960 |

single, $9,900; married, $15,600 |

$0 | $0 | up to $3.95 generic; $9.85 brand name | $0 |

| Medicaid | single, $13,836; married, $18,552 |

N/A | $0 | $0 | up to $1.35 generic; $4 brand name | $0 |

| Medicaid and/or Medicare Savings Program |

varies by state | N/A | $0 | $0 | up to $3.95 generic; $9.85 brand name | $0 |

| Partial Extra Help Medicare only |

single, $20,628; married, $27,708 |

single, $15,510; married, $30,950 |

varies based on income |

up to $99 | 15% coinsurance or plan copay if less | up to $3.95 generic; $9.85 brand name or 5% of drug cost |

Scroll right for additional columns.

Single is defined as unmarried or not living with your spouse; married is defined as wed and living with your spouse.

Premium for a basic Part D plan; some plans may cost more.

*Income limits based on the federal poverty level, which changes annually

**Until you've paid $7,050 in out-of-pocket drug costs and you reach the Part D catastrophic level

***After you've paid $7,050 in out-of-pocket drug costs, which is the Part D catastrophic level

Sources: Medicare Rights Center, Medicare.gov, Centers for Medicare & Medicaid Services, National Council on Aging

Once you’ve enrolled in Extra Help, Medicare will notify your Part D plan. If you notice that the credit isn’t being applied when you fill your prescription, you can show the pharmacist the approval letter from Medicare.

More assistance with medication costs

State pharmaceutical assistance programs (SPAPs), offered to some extent in all states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands, help eligible individuals pay for their prescription drugs. They can be useful to people who want to supplement their partial Extra Help benefits or to those who don’t qualify for the program.

Each state’s program works differently. In most states, residents qualify based on their income; in some, people also must have certain illnesses, such as HIV/AIDS or end-stage renal disease, to qualify. In some cases, the income eligibility requirement levels are higher than the ones for Medicaid or Part D’s Extra Help.

To find out more about your state’s SPAPs, visit Medicare.gov. You can also call 800-MEDICARE or contact your State Health Insurance Assistance Program.

Images: Social Security Administration (ssa.gov)

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger's Personal Finance magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.

This story, originally published Jan. 28, 2022, was updated with 2022 figures from the federal government.