How to Buy a Medigap Policy Online

If you have original Medicare, you can get supplemental coverage for out-of-pocket costs

When you sign up for Medicare, you have a lot of decisions to make.

One of the first choices is whether to sign up for original Medicare or a Medicare Advantage plan. If you decide to get your coverage through original Medicare, you can use any doctors or hospitals that accept Medicare payments. But you’ll still have out-of-pocket costs, such as deductibles, copayments and other expenses.

If you have employer or retiree coverage or Tricare military health insurance, those policies can fill in some of Medicare’s gaps. Otherwise, you may benefit from buying a supplemental Medigap policy from a private insurer. Although you’ll pay an additional monthly premium for a policy, it can cover some of Medicare’s deductibles, copayments and other out-of-pocket expenses. (Note that you can’t get a Medigap policy if you have a Medicare Advantage plan.)

You can buy a Medigap policy anytime, but in most states it’s best to do so within six months of enrolling in Part B. That way, insurers can’t reject you or charge more because of preexisting conditions.

Find the right policy

Although private insurers sell the Medigap plans, federal and state rules standardize the coverage. Insurers can offer up to 10 plans, each with a different letter designation.

In most cases, plans with the same letter must include the same benefits, no matter which insurance company offers it. (Massachusetts, Minnesota and Wisconsin offer a different set of standardized plans.) But the plans aren’t offered at the same price. Choose the letter plan that provides the coverage you want, then shop around on Medicare’s Medigap plan finder.

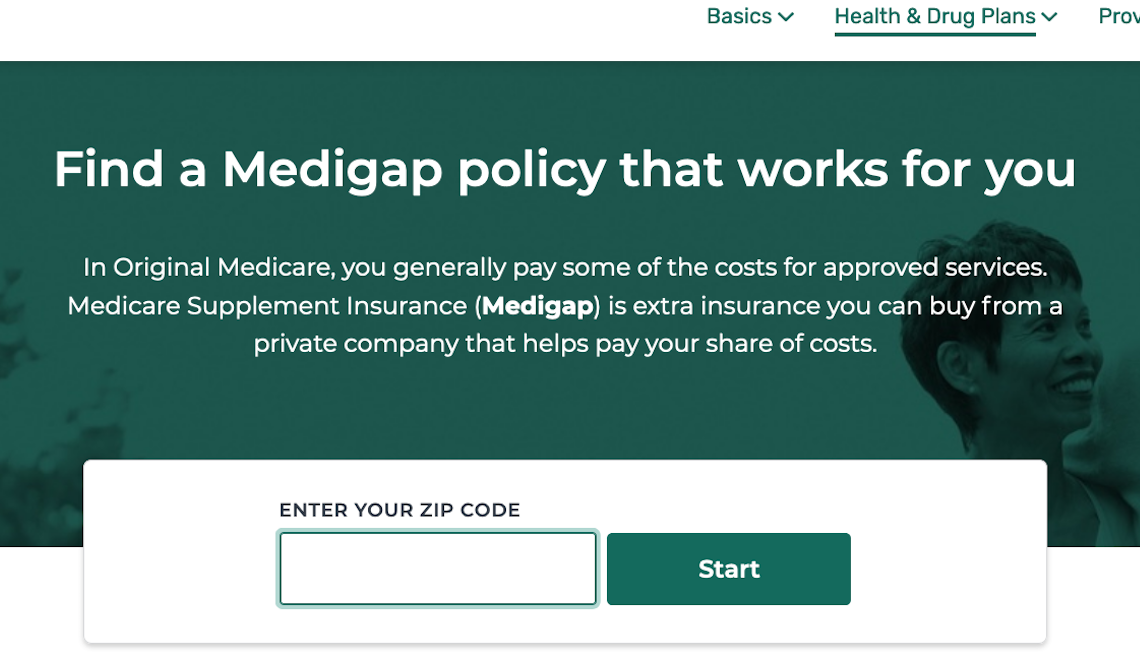

For information about what the policies cover, visit Medicare.gov. Here’s how to get a policy.

1. Go to the plan finder and type in your zip code.

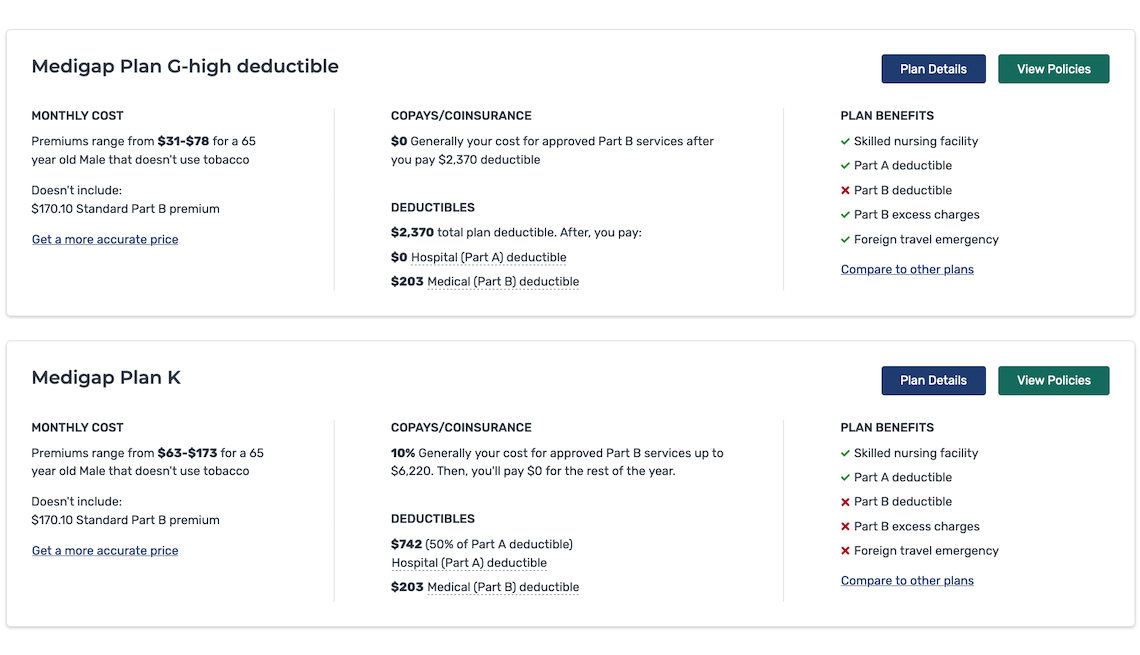

2. Enter your age, sex and whether you use tobacco, so you can get more accurate cost estimates. You’ll see price ranges and information about copays, deductibles and benefits for the letter plans in your area.

Below are the estimated monthly costs for Plan G (high deductible) and Plan K policies for a nonsmoking 65-year-old man who lives in Baltimore.

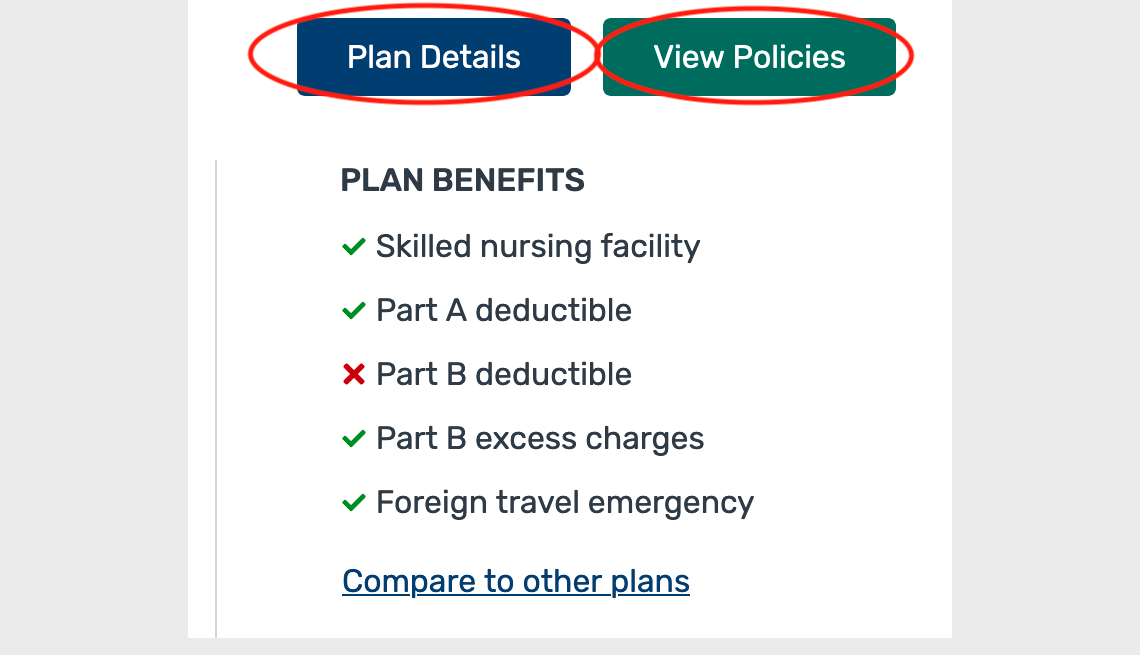

3. Click Plan Details for information about coverage and estimated costs. Click View Policies for a list of the insurers that offer Medigap policies with each letter designation in your area.

What you'll pay

Contact the plans you’re interested in for details about premiums. Medicare’s Medigap plan finder has links to websites for every plan. Follow the View Policies link and you’ll see a Visit company website link along with each company’s address and phone number.

Premiums for plans with the same letter designation can vary widely based on the insurer you choose. The 65-year-old man in Baltimore who doesn’t smoke and wants to look at Plan G offerings that don't have high deductibles can expect to pay $127 to $452 a month depending on the company, according to the plan finder.

Some companies give discounts for multiple policies and/or household discounts. Certain companies that use a formula called attained-age pricing to set rates initially offer a low premium to younger buyers but have regular premium increases based on age and inflation. With issue-age pricing, premiums are based on your age when you buy the policy and can increase because of inflation. A company that uses community-rated pricing charges the same premium to all people in a state who have a policy with the same letter designation, regardless of their ages.

AARP Membership -Join AARP for just $12 for your first year when you enroll in automatic renewal

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

As benefits vary across letter designations, so do monthly premiums. In 2021 average annual premiums for women ranged from $1,042 for a cost-sharing Plan K, which requires you to pay 50 percent of the Part A deductible and other expenses until you reach a $6,220 out-of-pocket spending limit, to $2,583 for a Plan C, which covers all charges that Medicare does not except for Part B excess charges. That’s a range of about $87 to more than $215 a month. Plans C and F aren’t available to people newly eligible for Medicare after 2019.

Average Medigap premiums for men are often higher because males typically have a shorter life span than females and tend to be less healthy. So, in general, they use more medical services more quickly. Men’s average annual premiums ranged from $1,133 for Plan K to $2,825 for Plan C — around $90 more for Plan K to about $240 a year more for Plan C than women.

Keep in mind: If more than six months has passed since you enrolled in Part B, your premium may be based on your health status. And you could wait up to six months to be covered for existing medical conditions.

If you buy a Medigap policy within six months of enrolling in Part B, or within 63 days of losing job-based health insurance that is considered secondary to Medicare (generally coverage from an employer with fewer than 20 employees), then you can't be charged more or be denied coverage because of any health problems. But, in most states, your premium can depend on your age, gender or smoking status.

Some state insurance departments list premiums for Medigap plans. To find your state’s insurance department, visit the National Association of Insurance Commissioners website and select your state in the pulldown menu under the second Insurance Departments section.

To buy a Medigap plan, contact the insurance company. Information is on company websites. You may be able to enroll online, by phone or by mail. You can also use an insurance agent.

You’ll pay your Medigap premium to the insurer, not to the federal government. Ask the company if it offers any automatic payment options and discounts for enrolling in an automatic payment plan or for insuring both you and your spouse with the company.

For help exploring your Medigap options, contact your State Health Insurance Assistance Program (SHIP). Its counselors often have information about prices and rules for specific plans available in your area.

Images: Medicare.gov

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger's Personal Finance magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.